WHAT IS A UNICORN COMPANY?

- Who Are They?

- How Are They Valuated?

- What’s Expected Of Them?

- How Are They Perceived?

Unicorn is a term used in the venture funds industry to indicate a privately held startup company valued at over $1 billion and usually no more than 10 years old. The term was coined in 2013 by venture capitalist Aileen Lee, choosing the mythical animal to represent the statistical rarity of such successful ventures.

At that stage, there were only 39 companies that were considered to be unicorns. She looked at software startups founded in the 2000s and estimated that only 0.07% of them ever reach $1 billion valuations. She noted startups that managed to reach the $1 billion mark, are so rare that finding one is as difficult as finding a mythical unicorn.

According to Lee, the first unicorn companies were founded in the 1990s with Alphabet (GOOG) or Google as it is now called, being the super-unicorn of the group with a valuation of over $100 billion. Many more unicorns came along in the 2000s with Facebook being at the top of the list and classed as the only super-unicorn for that decade.

Categorizing these companies have evolved and the terms used now are, Decacorn which is for those companies over $10 billion, while Hectocorn is used for such a company that valued over $100 billion.

Since Lee’s publication, the term unicorn, is widely used and refers to startups in the technology, mobile, and information technology sectors and usually integrates all three, questionably supported by their fundamental finances.

Average Life Of A Unicorn

According to Google, there were 465 unicorns as of April 2020. The largest unicorns included Ant Financial, Didi, Airbnb, Stripe, and Palantir Technologies. The most recent Decacorn is Lyft which became a public company on March 29, 2019. Generally, these billion-dollar valued unicorns become a public company or are bought out or merged with another successful public company.

In 1999 the average life of a company was 4 years before it went public. Now that has been stretched out to 11 years before a venture-supported technology company is listed. This is brought about by an increased amount of private capital available to unicorns, along with the increase of the number of shareholders a company can have before it is required to disclose its financials publicly. Notably, private investors can only take a position on unicorns when they choose to list.

No Need For An IPO

Through many funding rounds, companies do not need to go through an initial public offering (IPO) to obtain capital or a higher valuation as they can just go back to their investors for more capital. IPOs also run the risk of devaluation of a company if the public market thinks a company is worth less than its investors.

Just two examples of this situation were Square, best known for its mobile payments and financial services business, and Trivago, a popular German hotel search engine, both of which were priced below their initial offer prices by the market.

This was because of the severe over-valuation of both companies in the private market by investors and venture capital firms. The market did not agree with both companies' valuations, which in turn, dropped the price of each stock from their initial IPO range.

Where And Who Are The Unicorns?

Unicorns are concentrated in a few countries/regions: China (125), United States (124), India (27), South Korea (11), UK (10), Israel (7), Sweden (6), Indonesia (6), Singapore (4), France (3), Hong Kong (3), Portugal (3), Switzerland (3), Australia (2), Estonia (2), Belgium (2), Canada (2), Germany (2), Ukraine (2), and fourteen other countries (1 each).

The Top 10 Unicorn companies are listed in this image below

Former Unicorns

Below are the top 10 unicorns that exited due to an IPO or Acquisitions

Click the link to view the full list https://en.wikipedia.org/wiki/List_of_unicorn_startup_companies

NOTE: The companies in red on this list do not have a website.

The Valuation Of A Unicorn

The valuation of a startup company to be classed as a unicorn is unique in comparison to more established companies. For an established company, the valuation stems from past years’ performance, while a startup valuation is derived from its growth opportunities and expected development, so there is no actual math to estimate startups’ valuations.

Valuations for unicorns usually come from funding rounds of large venture capital firms. To give such high valuations in funding rounds, venture capital firms have to believe in the vision of both the entrepreneur and the company as a whole. They have to believe the company can evolve from its unstable, uncertain present standing into a company that can generate and sustain moderate growth in the future. This approach can backfire as it did when it hurt Softbank, a leading investor in WeWork who took a $4.6 billion hit when the company failed to float in 2019.

A very significant final valuation of startups is when a much larger company buys out a company and gives them that unicorn valuation. For example when Facebook bought Instagram for $1 billion.

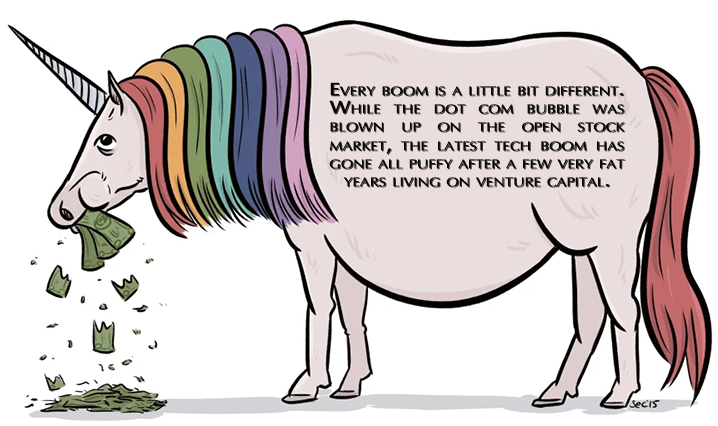

Bill Gurley, a partner at venture capital firm Benchmark predicted in March 2015 and earlier that the rapid increase in the number of unicorns may "have moved into a world that is both speculative and unsustainable", that will leave in its wake what he terms "dead unicorns". Also, he said that the main reason for Unicorns' valuation is the "excessive amount of money" available for them.

Similarly, in 2015 William Danoff who manages the Fidelity Contrafund said unicorns might be "going to lose a bit of luster" due to their more frequent occurrence and several cases of their stock price being devalued. Research by Stanford professors published in 2018 suggests that unicorns are overvalued by an average of 48%.

It’s In The Numbers

Businesses on the internet have made great headway. Some of the biggest businesses in the world, including Facebook, Amazon, Google, and Apple, are solidly established in the online tech world. A lot of other companies also have large, tangible revenue growth and earnings. They don’t buy users or customers with the hope of making money considering the inevitable attrition rate when those users eventually change their behavior.

So valuations shouldn’t depend on imaginary future earnings but on actual returns and EBITDA. (Earnings before interest, taxes, depreciation, and amortization) Amortization being affiliate fees or payments of an obligation of a series of installments or transfers.

Some argue that venture investors are getting over-enthusiastic when pricing businesses, inflating the price of startups that should be valued in the millions, not billions. Instead of carrying out proper risk analysis, they are diving in out of a fear of missing out on the supposedly next big thing.

Path To Profitability – The New Watchword

Silicon Valley’s crop of highly valued tech start-ups, which include Uber and Airbnb, now household names, all benefited from the mass adoption of smartphones and cheap cloud computing. Many of these companies built global empires by simply taking existing businesses, like taxis, food delivery, hotels, etc, and making them mobile, based online.

Now we are seeing the likes of robotics and Artificial intelligence (AI) startups wanting to be a contender for the next big thing in unicorns. However, growth at all costs has gone out the window after years of IPOs being done without much focus on profits. “Path to profitability” is the new watchword according to Ryan Dzierniejko of Sequoia along with Michael Moritz, another Sequoia partner who says “The law of economic gravity has returned as it does every decade or so”.

There are a considerable number of unicorn companies and the valuations seem to grow beyond the imagination of anyone. Is this the tech bubble 2.0?

The Unicorn Reality Check

Even before it was declared a global state of emergency due to COVID-19 on March 13, 2020, the unicorn reality check was underway with venture capitalists reckoning that a third of American unicorns would thrive, a third would disappoint and a third would be subject to an acquisition or die. Some are calling it the next dotcom bubble which burst 20 years ago with the advent of the internet and others are more optimistic. Either way, startup pastures that emerge in the aftermath of this economic upheaval will look very different.

The past decade saw huge sums of money from sovereign-wealth funds, also mutual and hedge funds pour in, either directly or via VC firms into startups that were unicorns or at the very least their backers believed they might be soon.

The jubilation began to diminish last year in May 2019, with Uber’s downturn of $43 billion, down more than a third of what it was on its first day of trading. Then, in October, WeWork, a “techie” office-rental group, scrapped its IPO after it became clear that investors had no appetite for shares in a firm that lost as much money as it generated in revenues. Its valuation was cut from $47bn to less than $8bn.

However, for Airbnb, a home-sharing website will bounce back from seeing bookings fall by 40% as the pandemic restricted travel and a possible delay of its IPO, (which was expected to be this year’s biggest) because, despite its losses of late, it is well managed and cash-rich. It also has an unmatched global reach and is likely to be back on track, making money once people are free to travel.

UNICORN – The New Buzzword In Marketing

Unicorns have come a long way since Aileen Lee coined the term in 2013, to convey wonder and rarity. Nowadays every startup wants to be one, for bragging rights and to hire the cleverest coders. Some are portraying themselves to be the next super unicorn to impress and lead potential users, consumers, and possibly victims into believing that the company is positioned to reach great heights and needless to say, using the term completely out of context.

“For millennials and Gen Zs being a unicorn became a filter,” says Jeff Maggioncalda, CEO of Coursera, a unicorn company that offers online learning courses and university degree programs.

A small Austin-based scooter startup called itself, simply, Unicorn. It was said to be an attempt to leverage the popularized name and what it stood for, as on a psychological level, people will tend to gravitate towards what they believe identifies as successful. The outcome? It subsequently failed when the firm went bust in December of 2019, after spending all its cash on Google and Facebook ads.

Artificial intelligence is a very generic term and used by many different industries for various use-cases, however, AI is being used in a way that is basically unchained and they’re not making smart decisions about it. It’s heading into areas that people don’t know about, giving it too much power and control and will ultimately get burned. It’s all about competition and the race to see who will create the best AI for any given industry.

Too many unicorns rest on shaky and opaque financial structures that may exaggerate their lofty valuations. These include “not-so-techy” capital-intensive firms such as WeWork, where accommodating more customers means leasing more physical office space.

Also, direct-to-consumer retailers such as Casper, which sell flashy bedding. The co-founder, Neil Parikh declared in 2016 that, “We consider ourselves a tech company first,” Stock Market investors considered it a mattress retailer. In February it listed at $575m, less than half its $1.1bn private valuation.

Artificial Intelligence (AI) used in marketing is more about automating simple tasks that allow us to free up more of our time to be strategic, effective, and less repetitive. It’s about improving processes while still keeping that human touch with customers and prospects. So you could say it’s automated intelligence. Some companies are taking it to the extreme with hype boasting they are first and foremost a tech company, and completely AI-based, but it is simply to generate a buzz.

Join for free here

The Next Unicorn

In terms of the next unicorn Randy Komisar of Kleiner Perkins, a big VC firm, offers an alternative rule of thumb. For a unicorn to count as genuinely “tech”, and therefore profitably scalable, its actual product must be technology, he says, “it can’t just be using technology.”

Businesses selling physical goods or services and startups offering online solutions with an already established market without proprietary technology often don’t make the cut.

As it stands now, even viable listings are on ice until the markets’ pandemic fever breaks. In the interim, the unicorn sphere is talking about consolidating. Softbank reportedly wants Uber Eats and Door Dash to merge. In the USA, Uber may try to charm Lyft into merging, whose share price has fallen faster than its own.

There is no magic formula for identifying the next unicorn company and only time will tell us whether the unicorn boom is a bubble or not. If today’s big startups go on to secure significant profits for their investors, they’ll be looked back on as a smart opportunity well taken. If they go the way of WeWork, then the unicorn boom will be remembered alongside the dotcom bubble as an example of investor folly.

Deb Williams

A Crypto/Blockchain enthusiast and a strong advocate for technology, progress, and freedom of speech. I embrace "change" with a passion and my purpose in life is to help people understand, accept, and move forward with enthusiasm to achieve their goals.

Markethive News

Great choice of the animal to categorize these companies with such special business grow