The Path to Financial Literacy: A Comprehensive Guide to Financial Mastery

Introduction

Financial literacy is the cornerstone of personal and societal prosperity. In an increasingly complex world, the ability to understand and manage finances transcends mere knowledge of numbers—it involves strategic thinking, disciplined decision-making, and a proactive mindset.

Financial literacy encompasses the skills required to manage personal finances, understand investment opportunities, and make informed decisions about savings, credit, and budgeting.

As economies evolve, the gap between financially literate individuals and those without these essential skills widens, often determining one's quality of life.

The journey to financial literacy is not solely an academic endeavor; it is a transformative process. It involves learning to decode the language of finance, such as interest rates, inflation, and diversification, while also addressing psychological behaviors like spending habits and risk tolerance.

This blog aims to provide a roadmap for financial literacy by exploring its key components and actionable strategies.

By the end, readers will be equipped with the knowledge and motivation to take charge of their financial future, fostering independence and long-term security.

1. Understand the Basics of Budgeting

Budgeting is the foundation of financial literacy. It allows individuals to allocate income toward necessities, savings, and discretionary expenses in a balanced manner.

A proper budget begins with assessing income sources and categorizing expenses into fixed (e.g., rent, insurance) and variable (e.g., entertainment, dining out) costs.

Creating a zero-based budget, where every dollar is accounted for, ensures that no money is wasted. This approach helps to establish financial priorities, such as an emergency fund or debt repayment.

Moreover, budgeting cultivates awareness about spending patterns, revealing areas where expenses can be trimmed without compromising quality of life.

By developing a budgeting habit, individuals lay the groundwork for achieving financial goals.

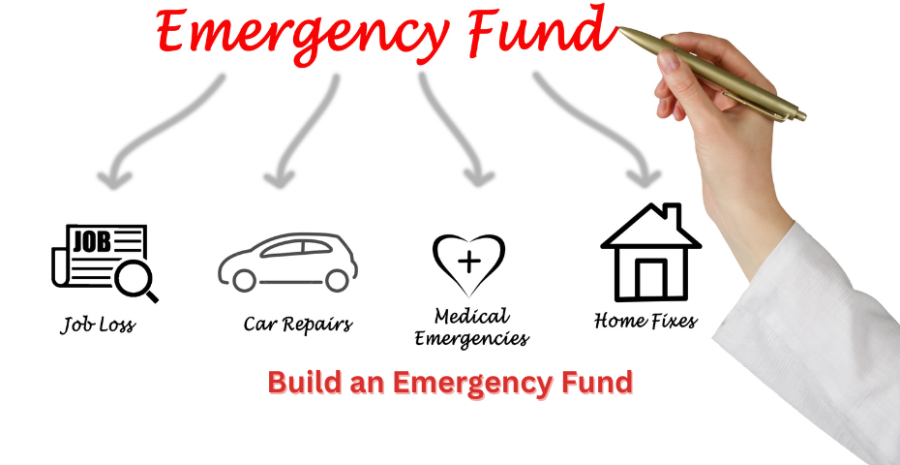

2. Build an Emergency Fund

An emergency fund is a financial safety net designed to cover unexpected expenses, such as medical bills or car repairs. Experts recommend saving three to six months’ worth of living expenses.

The purpose is to prevent reliance on high-interest debt during crises, which can spiral into long-term financial hardship.

Establishing an emergency fund starts small, with incremental savings from each paycheck. Keeping these funds in a high-yield savings account ensures liquidity and modest growth.

Beyond its practical utility, an emergency fund provides peace of mind, allowing individuals to navigate uncertainties with confidence.

3. Master the Art of Saving and Investing

Saving and investing are critical for wealth accumulation. While saving provides short-term liquidity, investing grows wealth over time by leveraging compound interest and market appreciation.

Understanding the difference between these two concepts is pivotal for financial literacy.

An effective savings strategy begins with setting aside a portion of income—commonly 20%—for both short-term goals and emergencies.

Investments, on the other hand, require knowledge of asset classes, risk tolerance, and market trends. Tools such as index funds, bonds, and real estate offer avenues for diversification, reducing overall risk.

4. Learn About Credit Management

Credit is a double-edged sword: when used wisely, it builds financial credibility; when mismanaged, it leads to overwhelming debt. Financial literacy involves understanding credit scores, interest rates, and repayment strategies.

Maintaining a healthy credit score—typically above 700—requires timely bill payments, low credit utilization, and a mix of credit types.

Monitoring credit reports regularly also helps identify errors or potential fraud. Wise credit management opens doors to favorable loan terms and financial opportunities.

5. Tackle Debt Strategically

Debt can be a significant barrier to financial freedom if not managed effectively.

Adopting a debt repayment strategy, such as the avalanche or snowball method, ensures systematic progress toward becoming debt-free.

The avalanche method prioritizes high-interest debts, saving money in the long term, while the snowball method focuses on small debts first, building psychological momentum.

Both approaches require discipline and a clear understanding of interest rates, minimum payments, and penalties.

6. Understand Taxes and Tax Planning

Tax literacy is an essential yet often overlooked aspect of financial education. Understanding how taxes work—income, property, sales, and capital gains—empowers individuals to make informed decisions about deductions, credits, and retirement accounts.

Using tools like tax calculators or consulting professionals ensures compliance while maximizing refunds or minimizing liabilities.

Proactive tax planning, such as contributing to tax-advantaged accounts like 401(k)s or IRAs, can significantly impact long-term wealth accumulation.

7. Cultivate Smart Spending Habits

Spending wisely is about distinguishing between wants and needs. Financially literate individuals develop habits such as comparison shopping, avoiding impulse buys, and taking advantage of discounts or cashback offers.

Tracking expenses through apps or spreadsheets enhances awareness and fosters accountability.

Over time, these practices reduce unnecessary expenditures and free up resources for saving or investing.

8. Plan for Retirement Early

Retirement planning is often delayed, yet starting early yields significant benefits due to compound growth. Financial literacy includes understanding retirement vehicles like pensions, 401(k)s, and IRAs, as well as their associated tax benefits.

Setting clear retirement goals, estimating future expenses, and consistently contributing to retirement accounts ensures a comfortable post-work life.

Automating contributions and increasing them with income growth accelerates progress toward these goals.

9. Learn to Protect Your Assets

Financial literacy involves safeguarding wealth through insurance and diversification.

Insurance policies—health, life, property, and liability—mitigate risks and protect against catastrophic losses.

Additionally, diversification spreads risk across asset classes, industries, or geographies, reducing vulnerability to market fluctuations.

Regular reviews of insurance coverage and investment portfolios ensure alignment with financial goals and life changes.

10. Seek Financial Education Continuously

Financial literacy is an ongoing process. The dynamic nature of financial markets, regulations, and products necessitates continuous learning.

Reading books, attending workshops, or subscribing to trusted financial blogs enriches understanding.

Engaging with a mentor or financial advisor provides personalized guidance.

Surrounding oneself with financially savvy peers also fosters a culture of informed decision-making.

Last Word

Financial literacy is a lifelong journey, requiring commitment, curiosity, and discipline. As the cornerstone of financial independence, it empowers individuals to navigate the complexities of modern economies with confidence and foresight.

By embracing the principles outlined above—budgeting, saving, investing, and continuous education—anyone can achieve mastery over their finances.

This pursuit is not merely about accruing wealth but about attaining freedom: the freedom to make choices, seize opportunities, and weather life's uncertainties.

Let today be the starting point for your financial literacy journey.

With persistence and a clear roadmap, the path to financial mastery is within reach.

.png)

About: Andries vanTonder

45 years selfemployed

He is a Serial Entrepreneur, an Enthusiastic supporter of Blockchain Technology and a Cryptocurrency Investor

Find me: Markethive Profile Page | My Twitter Account | My Instagram Acount | and my Facebook Profile.

Markethive News

.gif)