How to Fix Being Poor: Proven Strategies for Financial Stability

Introduction

Poverty is a persistent issue that affects millions of people globally, manifesting in limited access to resources, opportunities, and financial security.

For many, the struggles of poverty are not merely financial but also emotional and psychological, as the stress of uncertainty permeates every aspect of life.

While the reasons for poverty are multifaceted, ranging from systemic inequities to personal financial mismanagement, it’s crucial to understand that escaping poverty is possible with the right mindset, tools, and strategies.

This blog delves into actionable ways to overcome poverty and achieve financial stability, focusing on steps anyone can take regardless of their current circumstances.

The road to financial stability is not always easy, but it is paved with practical measures and a commitment to change.

Below, we outline 12 proven strategies that can help anyone build a more secure financial future.

1. Assess Your Current Financial Situation

Understanding where you stand financially is the first step toward improvement.

Create a detailed budget that lists your income, expenses, and any debts.

Analyze your spending patterns to identify areas where you can cut costs.

This exercise helps you see the full picture and prioritize essential expenditures over discretionary ones.

Being honest with yourself about your financial status is crucial to creating a sustainable plan for change.

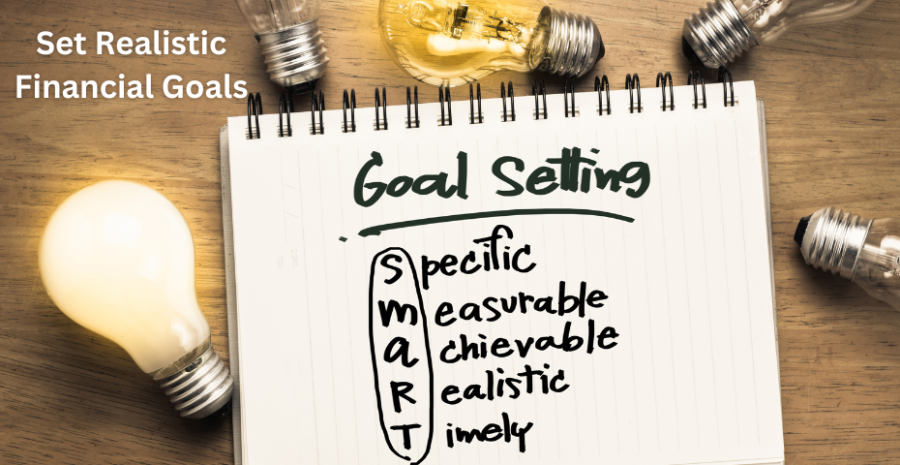

2. Set Realistic Financial Goals

Goals give you direction and motivation.

Break your financial objectives into short-term, medium-term, and long-term categories.

For example, a short-term goal could be saving $500 within three months, while a long-term goal might involve building an emergency fund or buying a home.

Make sure your goals are SMART: Specific, Measurable, Achievable, Relevant, and Time-bound.

3. Build a Strict Budget

Creating and sticking to a budget is one of the most effective ways to manage your finances.

Use tools like budgeting apps or spreadsheets to allocate every dollar a purpose, ensuring your expenses don’t exceed your income.

Prioritize necessities like housing, food, and transportation, and aim to save at least a small percentage of your income each month, even if it’s just 5%.

4. Focus on Increasing Your Income

Reducing expenses has its limits; at some point, you’ll need to focus on boosting your income.

Consider taking on a side hustle, freelancing, or pursuing additional training to qualify for higher-paying jobs.

Explore avenues such as selling unused items, starting a small business, or monetizing your skills online.

Diversifying your income streams can provide a safety net during tough times.

5. Tackle Debt Strategically

Debt can be a major barrier to financial stability. Start by listing all your debts and their interest rates.

Use strategies like the debt snowball (paying off the smallest debts first) or the debt avalanche (prioritizing high-interest debts) to reduce your obligations systematically.

Consider consolidating debts into a lower-interest loan if possible to save money in the long run.

6. Learn Financial Literacy

Financial literacy is the foundation of economic empowerment.

Take advantage of free or low-cost resources, such as online courses, books, and community workshops, to learn about budgeting, saving, investing, and managing debt.

The more you know about money management, the better equipped you’ll be to make informed decisions.

7. Build an Emergency Fund

An emergency fund acts as a financial cushion in times of unexpected expenses, such as medical emergencies or job loss.

Aim to save at least three to six months' worth of living expenses.

Start small if necessary; even setting aside $10 a week can make a difference over time.

Automate your savings to make the process easier.

8. Cut Unnecessary Expenses

Review your spending habits to identify areas where you can trim costs.

Cancel unused subscriptions, switch to more affordable service providers, and cook at home instead of eating out.

Being frugal doesn’t mean sacrificing quality of life; it’s about making conscious choices that align with your financial goals.

9. Take Advantage of Assistance Programs

Many government and non-government organizations offer assistance programs for those struggling financially.

These programs can include food assistance, housing subsidies, and healthcare benefits.

Research and apply for programs that can provide temporary relief while you work on improving your situation.

10. Invest in Education and Skill Development

Education and skill-building are key to increasing your earning potential.

Whether it’s completing a degree, attending workshops, or learning a trade, investing in yourself can pay off in the form of better job opportunities and higher income.

Many free or low-cost online courses are available to help you gain marketable skills.

11. Build a Support Network

Overcoming poverty is easier with the help of a strong support system.

Surround yourself with people who encourage and motivate you, such as friends, family, or mentors.

Networking can also open doors to new job opportunities and financial advice.

Don’t hesitate to seek professional help, such as financial counselors, if needed.

12. Develop a Long-Term Financial Plan

A long-term financial plan ensures you remain on track even after reaching your initial goals.

Incorporate elements such as retirement savings, investments, and insurance into your plan.

Regularly review and adjust your plan to account for changes in your income, expenses, and life circumstances.

Conclusion

Breaking free from poverty requires a combination of determination, education, and actionable strategies. While the journey can be challenging, it’s important to remember that small, consistent steps can lead to significant progress over time.

By assessing your financial situation, setting clear goals, building a budget, and continuously improving your skills, you can create a pathway to financial stability.

Additionally, leveraging resources like assistance programs and support networks can provide the temporary relief and encouragement needed to stay motivated.

Above all, cultivating a mindset of resilience and adaptability will empower you to overcome obstacles and build a brighter, more secure future.

Remember, poverty is not a life sentence; with the right approach and commitment, it’s possible to rewrite your financial story for the better.

As the world of entrepreneurship continues to evolve, Markethive remains a beacon of innovation, offering a secure, transparent, and empowering platform for all who seek to make their mark in the digital world.

About: Andries vanTonder

45 years selfemployed

He is a Serial Entrepreneur, an Enthusiastic supporter of Blockchain Technology and a Cryptocurrency Investor

Find me: Markethive Profile Page | My Twitter Account | My Instagram Acount | and my Facebook Profile.

Markethive News

%20(1).png)