Bitcoin NFT Mints Are Rising—But So Are Transaction Fees

Bitcoin users are putting assets on-chain, similar to NFTs on Ethereum, but there’s a cost to the increased activity.

By Jason Nelson

Bitcoin is the largest crypto asset by market cap. Image: Shutterstock

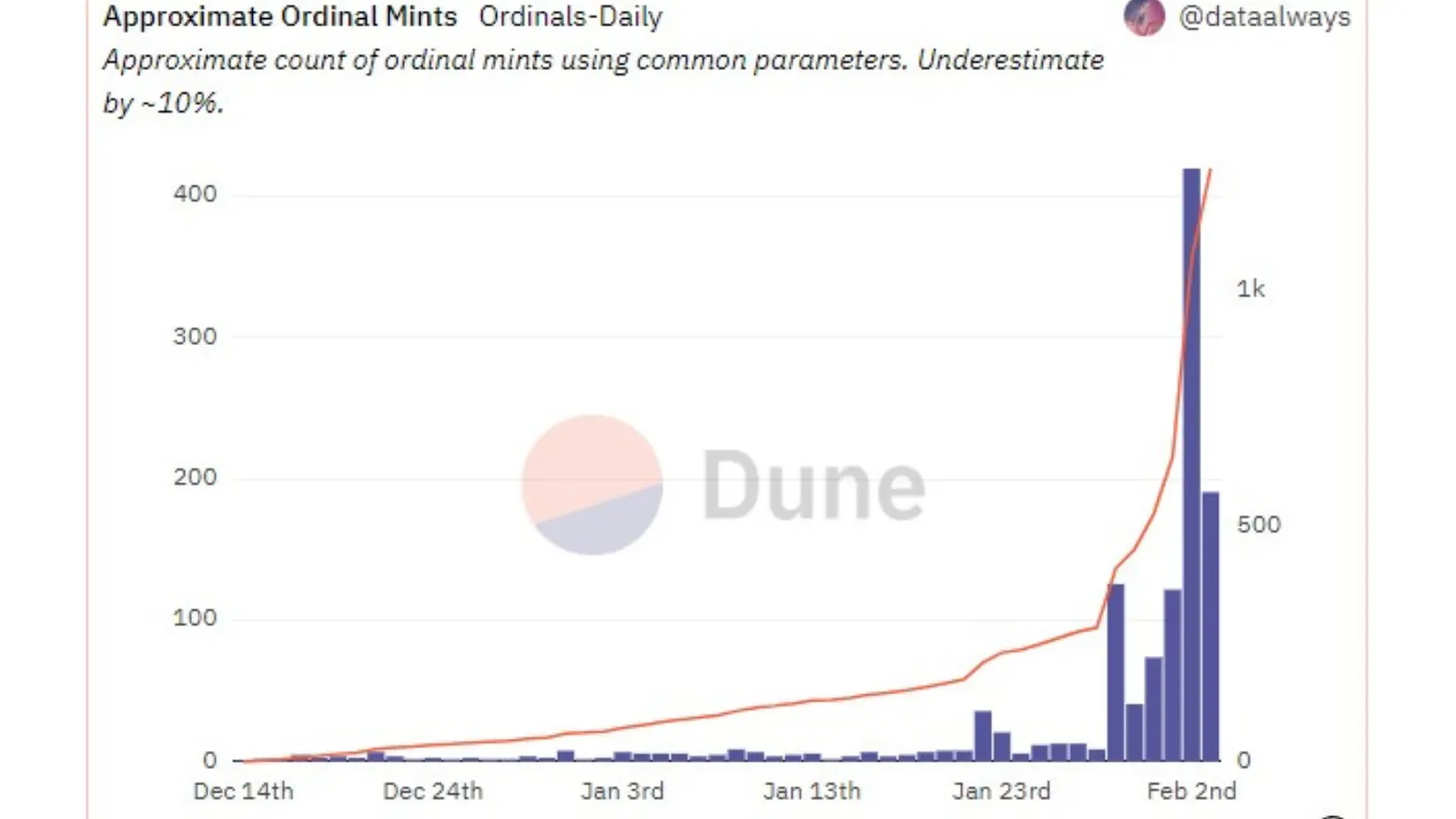

Ordinals, a controversial new project that lets users put NFT-like media assets on the Bitcoin blockchain, is seeing surging activity this week. On Thursday, Ordinals recorded its largest number of single-day mints—but network fees are apparently growing as a result.

More than 1,000 total Bitcoin NFTs have been minted via Ordinals, according to public blockchain data curated by Dune, topping that total on Thursday as 420 new “inscriptions” were made on the blockchain. That’s more than three times the amount of NFTs minted on Bitcoin via the process on Wednesday.

However, Thursday also marked the highest average transaction fee on Bitcoin in more than a month, landing at $1.53 worth of BTC per data from YCharts. That’s the highest it’s been since December 27, 2022

Image: Dune Analytics

The launch of Ordinals revived the heated and long-standing debate in the Bitcoin space about block sizes, legitimate transactions, and whether JPEGs and other media should be inscribed on the original blockchain. Thanks to the Taproot upgrade, Ordinals has allowed anything from knock-off Bored Apes to video games to be added to the Bitcoin blockchain.

NFTs are digital assets that are provably unique and linked to digital (and sometimes even physical) content like artwork, movies, and music files, and they can prove ownership of an item or membership in an exclusive group.

While blockchains like Ethereum and Solana are synonymous with NFTs, the practice of committing digital assets to a blockchain network has existed on Bitcoin since 2014, with projects like Counterparty and Stacks leading the way.

Rising transaction fees are an apparent side effect of adding NFTs to Bitcoin’s mainnet. Bitcoin transaction fees are determined by the volume of data in the transaction and the speed at which the user wants their transaction completed. Users who want their transactions to go through during periods of high traffic can decide to pay more fees to push their transactions through.

On January 21, when Ordinals launched, Bitcoin transaction fees topped out at 2.10% as a percentage of the block reward for miners—but on January 24, Bitcoin fees topped out at 3.44%, according to data from Hashrate Index. On Thursday, that figure reached 3.86%.

A closer look at the Hashrate Index data shows that the percentage is spiking at times during the day, including to a mark of nearly 8% late Friday afternoon. However, the overall daily average has thus far landed at a much lower number amid the rise of Ordinals.

The increase in transaction fees has led some Bitcoin maximalists to call Ordinals an affront to the Bitcoin ethos. Others say the project allows the spamming of the decentralized network.

It's sentiment that Ordinals developer Casey Rodarmor does not share. He told Decrypt on Monday that Bitcoin blocks need to be full to give users a reason to pay more than the minimum fee.

“If blocks are not full, then nobody has any reason to pay more than the minimum fee rate to have their transactions included in a block,” he said. “So as a result, blocks must be full."

He further explained that while he's keen on full Bitcoin blocks, he does not support increasing the size of the blocks. "I wouldn’t advocate to raise the block size,” he affirmed.

Even so, Ordinals are apparently affecting how people use the Bitcoin network, which may only fuel the continuing debate around their value and use.

Markethive News

.gif)

.png)