A Critical Report On Bitcoin Mining And Its Carbon Footprint

Finally, FACTS That Counter The FUD

Cryptocurrency is more popular than ever as the mainstream populace realizes its potential as a new monetary system, especially in light of hyperinflation in our legacy financial system. The control that the “powers that be” already have over our sovereignty and the introduction of Central Bank CBDCs will only result in a more oppressive regime for sovereign citizens.

There are factions of people intent on discrediting crypto to minimize adoption, particularly Bitcoin or any Proof of Work protocol that relies on mining. Their primary focus is on damage to the climate due to fossil fuel emissions, even though the statistics for their claims have been negligible and inconclusive at best.

China’s recent ban of all crypto-mining is purported to be for the concern of excess carbon emissions. Arguably, the real reason for the ban was to push the Yuan CBDC already in circulation. Central Bank Digital Currencies are not a cryptocurrency but a financial system to exercise total control of its people. This ties in with China’s Social Credit System and publicized scoreboard pictured below.

Image Source: Reddit

Bitcoin Mining Report To End All FUD

The highly reputable firm, Coinshares, has published a recent report to counter this argument of concern ramped up last year, under the guise of ESG. The report illustrates how much of an effect Bitcoin mining has on the climate relative to other industries, including printing fiat currency, and what it means for Bitcoin.

Bitcoin Mining report begins with a brief history of the concerns about the energy used by Bitcoin mining. This includes a famous response from Bitcoin creator Satoshi Nakamoto, who already dealt with energy critics way back in 2010.

“The utility of the exchanges made possible by Bitcoin will far exceed the cost of electricity used, therefore not having Bitcoin would be the net waste.”

The authors of the report agree with Satoshi because the economic incentive to spend caused by the constant inflation of fiat is wasting a lot more energy than Bitcoin mining and destroying the environment.

The report also points out that concerns about Bitcoin mining are recurring subjects that tend to get resurrected in full force with each successive market cycle. In other words, when Bitcoin is on the rise and sensationalist commentators have not been shy about offering their (often poorly supported) opinions. However, many Bitcoin-fluent commentators have conveyed retorts to the contrary.

The authors also mentioned that they would be open-sourcing the model and the data they used. So that crypto critics and supporters alike can play around to see what it says about Bitcoin mining.

The second part of the Bitcoin mining report lays out the methodology the authors used to measure the carbon emissions created by Bitcoin mining. They start by making an essential point that “Bitcoin, like electric cars, is as green as the electricity you feed it, meaning that in a 100% renewable energy environment, Bitcoin would be 100% renewables driven.”

The report then breaks down the three components in their methodology. These are; calculating network efficiency, carbon emissions, and a variety of assumptions in terms of network efficiency.

The authors then estimated the total energy use by looking at the total Bitcoin Blockchain hash rate. When calculating carbon emissions, they looked at the different regions where Bitcoin miners are based and how those regions get their power logically. If a territory is getting 100% of its power from fossil fuels, it's safe to assume that any Bitcoin mining operations in that region use those same energy sources.

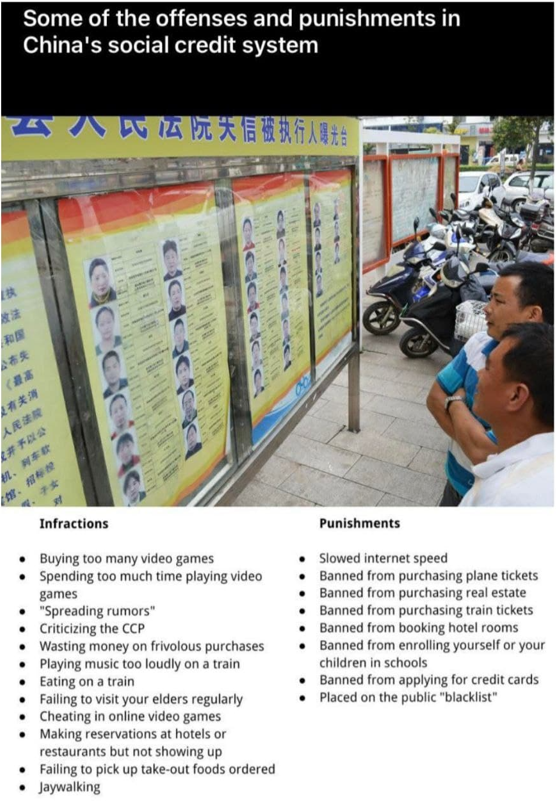

One of the most important results is Bitcoin's total energy use, a highly sought-after statistic by interest on both sides of the debate. It quotes that

“The Bitcoin mining Network uses approximately 0.05% of the total energy consumed globally. This strikes us as a small cost for a global monetary system, and on the global energy balance sheet, it amounts to a rounding error.”

The report unpacks how Bitcoins energy use is distributed across different regions, with the United States leading in crypto mining, since the China ban. Currently, it accounts for the most significant slice of the energy pie at around 42%. Kazakhstan comes in second place at 22%, and Canada is third with 11.5%. After crunching the numbers, the authors also found that China currently generates about 7% of Bitcoin’s hash rate, despite the country's crypto ban.

Source: Cryptonews.com

Carbon Emissions

Another set of results relates to the carbon emissions associated with Bitcoin mining, and it starts with the statistic that made crypto news headlines. According to the author's analysis, the carbon emissions related to Bitcoin mining account for “less than 0.08% or less than 1/1000th of the global total.”

To put things into context, this is only around 4X more than the carbon emitted to just create fiat currencies. It's less than a third of the carbon emitted by the gold industry, almost less than a third of the carbon emitted by the global banking system, and slightly less than the carbon emissions of dryers each year.

Source: CoinShares Research (Jan 2022)

Now, these comparisons are in stark contrast to the comparisons you see in clickbait headlines about crypto mining and the climate. Coin Bureau explains the FUD and false claims that crypto is bad for the environment in the video below.

Carbon Emissions On The Decline

The report indicates the decline in carbon emissions will be more aggressive in the Bitcoin mining industry due to the mobility of miners and their incentive to seek out the cheapest energy sources, which are almost always renewable. It allows miners to take advantage of cheap, newly constructed renewable energy generation faster than other industries.

“As of December 2021, we estimate the relative contributions of coal, gas, hydro, nuclear, and wind at 35%, 24%, 21%, 11%, and 4%, respectively. The remaining generation of 5% is a mixture of small amounts of oil, solar and other renewables, mainly geothermal.”

This means that more than 1/3 of Bitcoin's energy comes from renewable energy sources.

Image Source: FreePik

The US currently dominates the global Bitcoin hashrate, and in places like North Dakota, mining is solving flare gas emissions. In Wyoming, they focus on wind farms as an abundant renewable energy source. Solar panels are a prolific innovation to homes that reward homeowners and supplement veterans’ incomes.

As cited in the Bitcoin Mining Report, they expect Bitcoin miners to start consuming large amounts of wasted flare gas. If this becomes a large enough share of the mining energy input, the mining network could become carbon negative.

The authors point out that the best way to minimize Bitcoin mining emissions is for western governments to create a policy that attracts them to regions that use more renewable energy. Outright banning Bitcoin mining, punitive taxation, or oppressive regulation would just result in mining operations relocating to areas that use fossil fuels as their primary energy source.

The only reason why Bitcoin miners are in those regions right now is that the governments provide massive subsidies to fossil fuel companies, which makes dirty energy artificially cheaper than clean energy. While western countries are not entirely free from fossil-fuel subsidies, they are much smaller than in countries such as China, Kazakhstan, and Iran, where coal, oil, and gas are all heavily subsidized by the state.

Image Source: TextileLearner.net

Carbon Credits For Bitcoin??

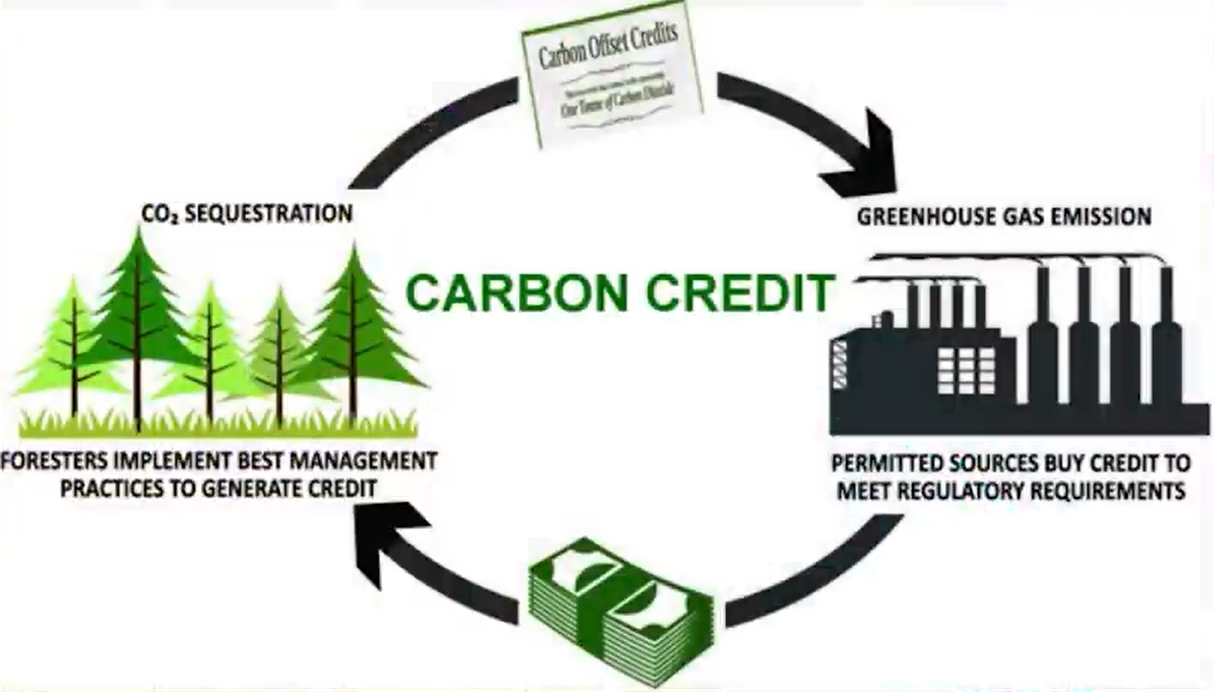

The authors then pivot to an interesting possibility of whether it would be financially feasible to offset bitcoin’s existing carbon emissions through the purchase of carbon credits. Carbon credits are essentially certificates given to companies by government authorities when they do something green, such as adding a solar panel to their facilities.

Furthermore, the holders of the carbon credits can be traded. They're often purchased by companies that produce emissions to avoid emission sanctions, as one carbon credit gives its holder the right to emit one ton of carbon dioxide. Interestingly, Tesla makes most of its money from selling carbon credits it receives.

Ironically, Tesla banned Bitcoin from being used to purchase its cars for being classed as environmentally unfriendly by erroneous sources, which up till now was speculative and arguably fear-mongering and profiteering. Think Al Gore.

Carbon credits are an interesting idea; however, the authors calculated and determined that the carbon output of Bitcoin mining could be offset at the cost of USD 200 per BTC. This works out to less than ½% of Bitcoin mining revenue, assuming an average price of $42K per Bitcoin.

As stated in the report,

Another interesting takeaway from the emissions figures is that they can be used to calculate the carbon offsetting cost of holding one bitcoin for one year. Assuming the cost of emissions is shared equally among all holders of bitcoin, at 18.9 million bitcoin outstanding, each bitcoin would require offsetting 2.2 tonnes of CO2 per year, or roughly the same as one return flight on Business class between New York to Tokyo.

Image Source: CoinShares.com

Report Wrap Up

The authors of The Bitcoin Mining Report conclude by emphatically stating,

In the grand scheme of things, the carbon emissions emitted by electricity providers supplying the Bitcoin mining network are inconsequential. At 0.08 % of global CO2e emissions, removing the entire mining network from global demand—and thereby depriving hundreds of millions of people of their only hope for a fair and accessible form of money—would not amount to anything more than a rounding error.

They say that to provide its combined services of open peer-to-peer, objective, censorship-resistant, and trust minimized participation in a global monetary network, Bitcoin strictly requires a non-zero amount of input energy in perpetuity. The future magnitude of this requirement is unknown. In other words, the authors acknowledge that the energy needed to maintain the Bitcoin blockchain will continue to increase indefinitely until the last Bitcoin is mined.

The authors also note that Bitcoin’s future energy use is irrelevant because almost every other industry will require more energy in the future as well. What's important is that this energy use doesn't involve any fossil fuels, to which the authors say, “Bitcoin will be 100% renewable, as soon as our electricity generation is 100% renewable.”

Currently, the vast majority of energy is used for mining new coins, but mining is programmatically preset to decay to zero over the next 100 years geometrically. Already by the decade of 2040, more than 99% of all bitcoins will have been mined. Once mining is effectively over, the vast majority of the energy requirement will result directly from market demand for Bitcoin transaction settlement through transaction fees offered to miners by consumers.

They then conclude the report with,

“Our focus should be on building out renewable power generation, not on stifling the development of monetary technology. When analyzed over the long term and in the proper context, we believe that the emission costs of Bitcoin are dwarfed by its benefits. ”

Image Source: Markethive.com

The True Nature Of Bitcoin

Bitcoin is more than a cryptocurrency. It's decentralized and the most secure payment network. Its security is made possible by the proof of work (POW) consensus mechanism. Also, it’s the most battle-tested Blockchain and considered the digital gold or store of value in which all cryptocurrencies are based, so Bitcoin is the ideal currency to hold.

The Bitcoin Blockchain has its share of performance issues compared to the emerging Proof of Stake (POS) protocols, like Elrond and Cardano Blockchain Networks. However, going forward, some crypto projects such as Stacks are building a Smart Contract compatible layer for the Bitcoin Blockchain, and others like the Lightning Network are building seriously scalable payment systems.

As it happens, institutional investors value security more than anything else. And one of the only things standing in the way of them and BTC are their environmental concerns, which will hopefully subdue as this groundbreaking report circulates.

There are decentralized ecosystems emerging in the cryptocurrency space in various industries including the social media and marketing spectrum that rely on credible, infallible Blockchain systems, be it POW or POS. As technologies advance, both protocols will offer an alternative financial system delivering financial freedom and sovereignty at minimal cost to the climate and surrounding environments.

Source: Coinshares.com, Coinbureau.com

Also published @ BeforeIt’sNews.com https://beforeitsnews.com/environment/2022/02/a-critical-report-on-bitcoin-mining-and-its-carbon-footprint-2606186.html

Markethive News